Book

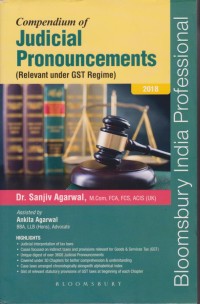

Compendium of Judicial Pronouncements (Relevant under GST Regime)

A comprehensive digest of judicial pronouncements on indirect taxes relevant to Goods and Services Tax (GST) covering important and landmark case laws, pronouncements of Tribunal, High Courts and Supreme Court of India including foreign cases.

One of its own kind, this compendium has been divided into thirty chapters covering almost the entire gamut of GST laws brought into force from 1st July 2017. A separate chapter exclusively digests most of the judicial pronouncements delivered by various High Courts on Goods & Services Tax so far. The gist or extracts of statutory provisions of CGST Act/UTGST Act/SGST Act/IGST Act have also been provided at the beginning of each Chapter to provide the relevant law pertaining to the Chapter and erstwhile provisions, if relevant. Since the principles of interpretation remain the same, the work provides sound and legal basis to understand and interpret the GST laws.

The book also contains an alphabetical index of case laws digested, besides meaning of important legal maxims generally used.

Key features

• Over 3600 cases relevant to Goods and Services Tax digested

• Interpretations useful to understand GST laws

• Provisions of GST laws covered under 30 Chapters

• Covers principles of interpretation of tax laws

• Useful interpretation of various terms/phrases/expressions used in tax laws

• Case laws arranged chronologically in each chapter along with alphabetical index for easy search

• Multiple citations of cases reported

• Special Chapter on GST cases reported so far

• Relevant and important cases reported upto January 2018 digested

• Meanings of legal maxims

Detail Information

| Call Number |

28 COM san

|

|---|---|

| Publisher | Bloomsbury Publishing India : India., 2018 |

| Collation |

cx1ix, 1000 p; 23,5 cm

|

| Language |

English

|

| Classification |

28 COM san

|

| ISBN/ISSN |

9789386606037

|

| Edition |

-

|

| Subject(s) |